Social and News

Una gran bella giornata…per un utile scopo!

Cogliamo l’occasione per ringraziare innazitutto i partecipanti per la presenza e la generosità nelle donazioni, senza dimenticare chi si è reso disponibile per contribuire all’ottima riuscita dell’evento: GODSPEED (E)BIKES ed i Ristoranti La Serra di Pambio Noranco e Posta di Carona…al prossimo anno!

Read More...

“L’istruzione è l’arma più potente che puoi utilizzare per cambiare il mondo.” Nelson Mandela

Read More...

“Wait and drink a tea”

We just got over an important weekend for Europe. Our fellow Germans voted and, as usual, their choices will affect European politics and economy, like it or not. Looking at the provisional results of the federal election we got an indication of a victory for the center-right CDU/CSU with 28.6% of the vote, followed by the far-right AfD (20.8%), center-left SPD (16.4%), Greens (11.6%), and socialist die Linke (8.8%). The far-left BSW (4.97%) and liberal FDP (4.3%) failed to reach the 5% threshold, meaning that, as things stand, they will not be represented in the Bundestag…

Read More...

“Deep…Setback or Deep…Sweet Spot?”

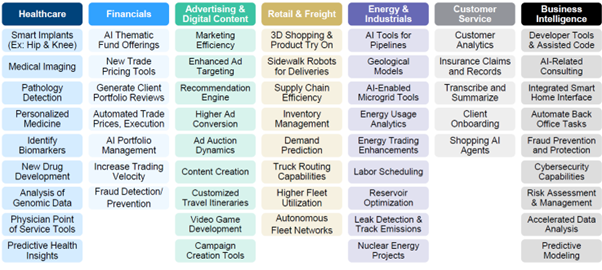

DeepSeek (DS) AI chatbot, unveiled in late January, has been overwhelmed with demand and sparked a $1 trillion rout in US and European technology stocks.

DS’s potential benefits span across various domains:

– Enhanced AI Capabilities: DS has shown superior performance in several tasks compared to existing AI models. This could lead to significant advancements…

“European fixed income: cosa attenderci da tassi e credito nel 2025”

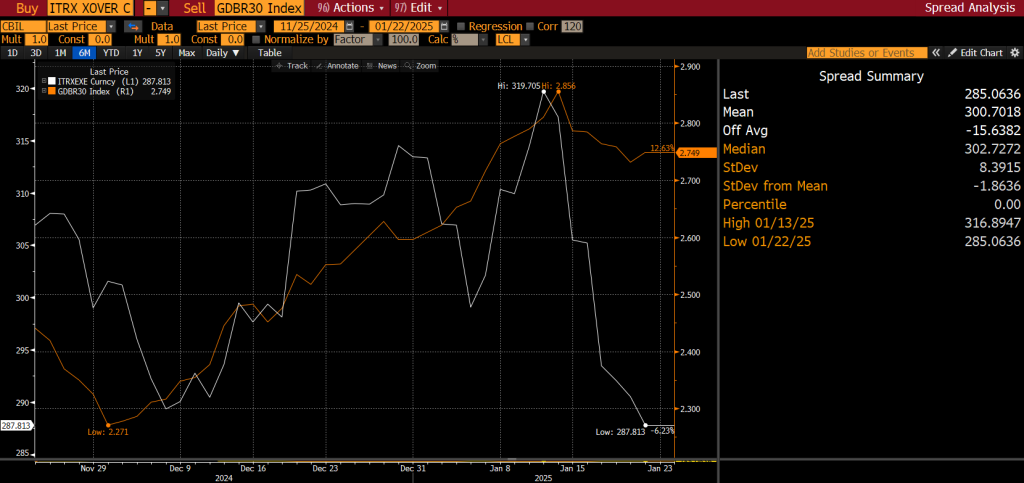

A partire da fine Novembre del 2024 abbiamo assistito ad un movimento importante dei tassi in Europa. In poco meno di 2 mesi il rendimento del Bund tedesco a 30 anni è passato da 2.3% a 2.85%, un movimento di 45 basis points simile all’incremento del rendimento del Bund tedesco a 2 anni, passato da 1.9% a 2.32%. Nello stesso periodo l’ITRAXX CROSSOVER, un paniere composto da CDS a 5 anni di 75 emittenti europei con rating sub IG, ha fluttuato in un range tra 280 e 320 basis points, rimanendo dunque nella parte bassa del range che il paniere ha avuto dal 2008 (post Lehman) a oggi…

Read More...

“The high cost of data dependency”

Since the Great Financial Crisis, central bankers have increasingly emphasized their “data-dependent” approach to monetary policy. Janet Yellen often signaled that decisions about interest rate hikes would rely on economic indicators such as inflation, employment, and GDP growth. Fed Chair Jerome Powell has repeatedly used “data dependent” to describe policy decisions in this period of heightened inflation and economic turbulence. Mario Draghi too adopted similar language when navigating the aftermath of the European debt crisis and deciding on asset purchase programs and interest rates; President Lagarde followed on his path. As a matter of fact, after the COVID-19 pandemic, central banks faced unprecedented uncertainty and guided markets on their actions amid volatile data on inflation and economic recovery…

Read More...

…Inference and Generative AI: is it really too early to get excited about? (2/2)

While generative AI offers exciting opportunities, it also raises challenges, particularly related to ethics, biases in generated content, and the potential for misuse in areas such as deepfakes. As these technologies continue to evolve, there is an increasing need for regulation and responsible development to ensure their benefits are maximized without unintended consequences. We think Anthropic, for example, is working on the right balance between innovation and ethics…

Read More...

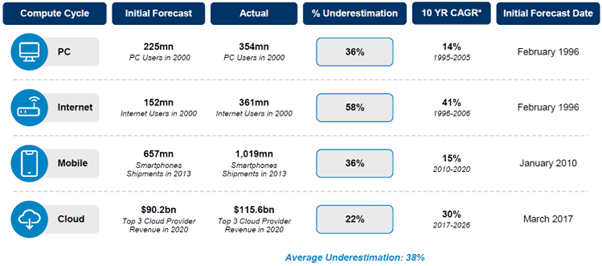

Inference and Generative AI: is it really too early to get excited about? (1/2)

Inference and generative AI are two critical concepts driving the advancement of artificial intelligence (AI) technologies today. While inference AI focuses on making predictions or decisions based on existing data, generative AI aims to create new, realistic data such as text, images, or music. Together, these technologies will reshape the business landscape of many companies operating in wide variety of sectors from healthcare and entertainment to finance and design…

Read More...

Getting close

We are approaching an important event that will shape our future for the next 4 years and beyond: U.S. presidential election.

Preparing for the 5th of November presidential race, financial markets are taking a very clear stance: Trump is very likely to win…

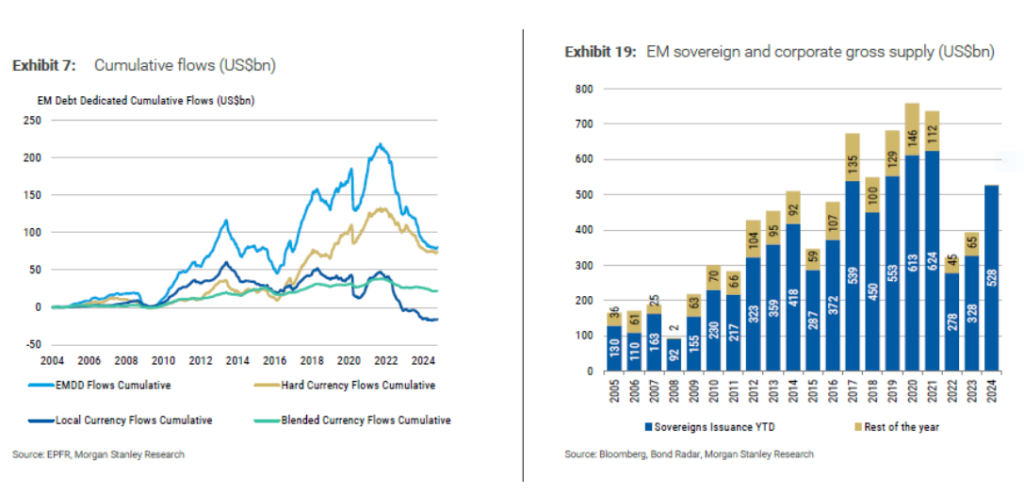

A favourable macro backdrop for Emerging Market Debt

The low economic growth remains supportive for emerging market issuers, the FED is expected to continue easing its policy amid declining inflation while only a moderate new bond supply in 4Q should reduce technical pressure on the market.

Default rates are likely to stay low in 2024 and 2025, which should support low volatility in emerging markets debt corporate credit spreads, thus bolstering appetite for carry in this asset class…