Social and News

La “Ride and walk” per aiutare l’Etiopia

Si è svolta domenica la «Ride and walk with Compass for Africa», una giornata pensata per raccogliere donazioni e creare consapevolezza per l’operato della Fondazione Nuovo Fiore in Africa che la Compass Asset Management, dal 2014, sostiene nella costruzione di scuole in alcune aree dell’Africa.

View

NO CHINA FOMO (Fear Of Missing Out), FOR NOW

Like most of investment professionals, this morning I spent most of my time reading comments from strategists, analysts, and journalists on the recent Fed meeting. Every word from Powell was screened with the highest attention. Rightly so since major central banks greatly influence expectations that influence the economy that influence market prices in a never-ending circular trend….

Read More...

“Soft landing or no landing?”

With recent macro data in US, which shows a continuous strong job market (at least at the surface), strong economy and resilient inflation (the last 3 CPI print have all surprised to the upside), the market narrative is shifting from a disinflationary boom and soft landing to an inflationary boom and no landing. This change in narrative has consequences for financial markets…

Read More...

“Switzerland First”

On the 21st of March, the Swiss National Bank cut rates, becoming the first central bank to do so in the G10 FX spectrum in 2024.

Despite the consensus of economists expecting them to remain on hold, the SNB lowered the policy rate by 25bps from 1.75% to 1.5%. The evidence that such move was a…

Read More...

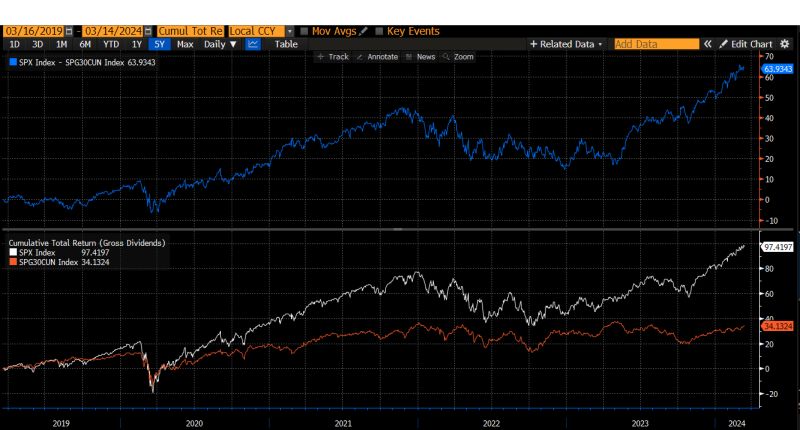

Interesting chart that shows us that remarkable overperformance of the S&P 500 Index vs the S&P Global 1200 consumer staples Idx.

The situation in Europe is not that different by looking for example at the ratio between European Cyclicals 12m fwd P/E vs Defensives being at the moment more than 1 stdev above the average of the last 25 years…..

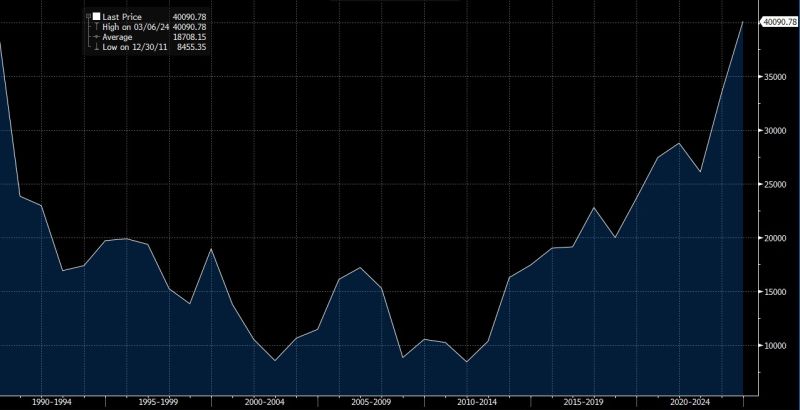

The end of the “Ex-Japan” era

In the last few months investors have been laser focused on Tech. The rise of Artificial Intelligence, the unstoppable move in the Magnificent 7 stocks and the return of Cryptos got everyone’s attention. However, behind the scenes, there is an underlying trend in the market that I believe does not get enough credit from the investor community, i.e. Japanese stocks are hot again…

Read More...

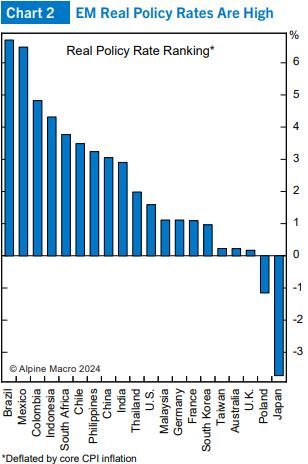

Still good opportunities in EM fixed income and FX markets

Falling rates along with the avoidance of recession create a healthy environment for emerging markets, both fixed income and fx. Inflation remains under control across emerging economies, with long rate cutting cycles to take root…

Read More...

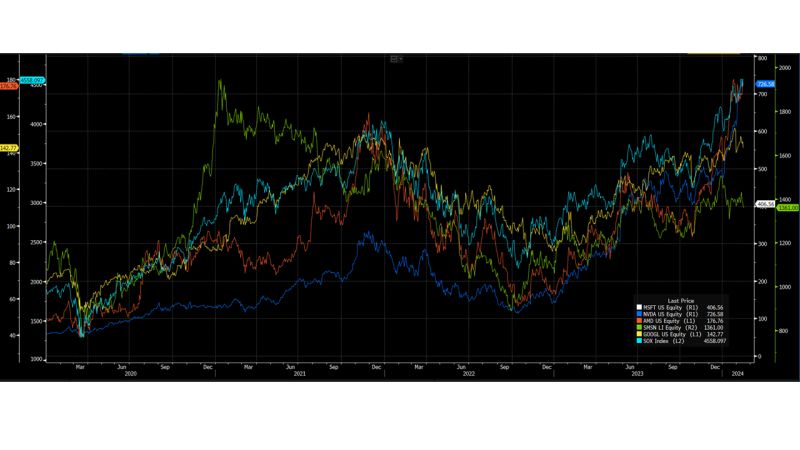

Is there still life after the Chips’ hype?

the key question to answer is not whether the AI hype will last but how to select the companies being able to move first in the processes of exploiting the advantages of this technological disruption (monetization).

Semis were by construction the first beneficiaries and the graph below simply shows the overperformance of the 2 market leaders (NVDA and AMD)….